The idea of outsourcing your Ambulatory Surgery Center’s (ASC’s) billing and collections can be an intimidating prospect. When you’re accustomed to having an employee physically in front of you to answer any questions in real time, it can be an adjustment.

That said, many practices are already considering outsourcing their billing. An outsourced billing model continues to gain popularity as facilities get busier and Medicare approves more procedures to be performed in an ASC setting. Revenue cycle employees' salaries and benefits can easily make up more than 22% of a facility’s net revenue. Staying in your comfort zone might make you feel better, but is it contributing to the success of your ASC?

When discussing outsourcing billing for the first time, the most common concern we hear from potential clients is related to cost. We understand, profitability is the goal of all ASCs, and the more the better!

When we take a closer look, we find the average revenue cycle specialist’s salary and benefit package costs an ASC $71,000 a year. This person is typically responsible for coding, charge entry, posting of cash, follow up on claims, tracking down unbilled cases, calling patients for insurance verification, collecting deductible/copays, and filing appeals for unpaid claims. In addition to making sure all cases completed are coded, operative notes are dictated, queries are added, and path reports/implant invoices are gathered for billing. Even for a medical billing rockstar, that’s a very full plate. We encourage you to analyze the effectiveness of your current model against these industry standards:

- Aging buckets 60+ under 25%

- 120+ under 9%,

- Days in AR under 30

- Meeting collection goals

How are things looking? If your ASC is not meeting these standards, quite simply, you’re leaving money on the table.

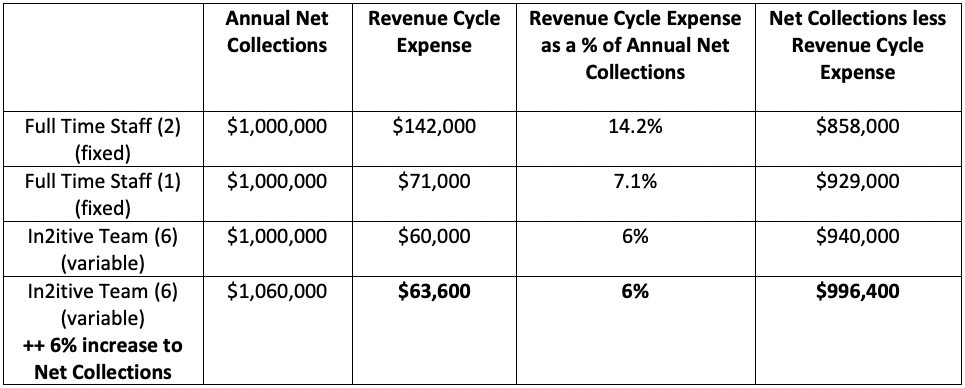

In addition to the results of your analysis, you’ll want to consider what you’re paying to achieve these results. Below is a cost comparison analysis we recently completed for a potential client. In this example, the center is employing 2 full time revenue cycle professionals. Transitioning the revenue cycle function to in2itive will allow them to increase their bottom line by about $138,400. Not a bad day! It is also worth noting, even if they only had 1 full time revenue cycle professional on staff, we could still save them $67,400, and a lot of headache!

*in2itive sees an average of a 6-8% increase to net collections their first year of working with a center.

*6% of Annual Net Collections is not an across the board fee. Please contact us for the most competitive pricing for your center given your case volume, payer mix and specialty.

It’s also worth noting, that a strong billing partner does more than just raise net collections on average 6-8%. Our clients eliminate several expenses, such as, hiring and training revenue cycle staff, office space expense, and annual raises or bonuses. We also remove the need to find leave, vacation and sick coverage.

Patient care is priority number one in ASCs, and our Revenue Cycle Management Service allows you to spent more time focusing on just that. Let us increase your bottom line, while decreasing the strain on your time.

Sources: Indeed.com, “Revenue Cycle Specialist Salaries in the United States,” Updated July 9, 2020, Accessed July 14, 2020.

https://www.indeed.com/salaries/revenue-cycle-specialist-Salaries#:~:text=Revenue%20Cycle%20Specialist%20Salaries%20in%20the%20United%20States,-1.1K%20salaries&text=The%20average%20salary%20for%20a,year%20in%20the%20United%20States.

Leave us a comment below or give us a call today at 855-208-5566!